Introduction

Covid-19 has caused a surge in demand and a shortage in supply, resulting in skyrocketing inflation worldwide since 2021. This has raised concerns for the overall economy, and insurers have also felt growing pressure from inflation.

According to research from the Geneva Association, titled The Return of Inflation, inflation significantly reduces the performance of non-life insurance due to increasing claims payouts. When non-life contracts are created, the claims are estimated based on the assumption that inflation will remain unchanged, while the payout period can last several years, especially for liability products.

When inflation occurs, the cost of fulfilling the insured obligation becomes more expensive, leading to a need for increased claims reserves for non-life contracts. On the other hand, while interest rate increases may result in better yields from short-term bonds (which non-life insurers purchase), this effect is estimated to be insufficient to offset the increase in claims and expense inflation.

Non-life insurers face significant pressure due to these factors. Under IFRS 17, the impact on insurers' performance manifests itself in various ways. However, the document does not provide specific details on how insurers' IFRS 17 performance is affected.

Based on the half-year results for 2023 reported by a few global (re)insurers under IFRS 17, there is a consistent message regarding experience variance resulting from prudent reserving and inflation. You can find more information in the respective reports: Allianz Interim Report, SCOR, Admiral Group. However, from the reports its not clear how inflation affects the IFRS financials. To get a better understanding, let’s have a look at an example.

To answer this question, let’s set a simple example.

Example

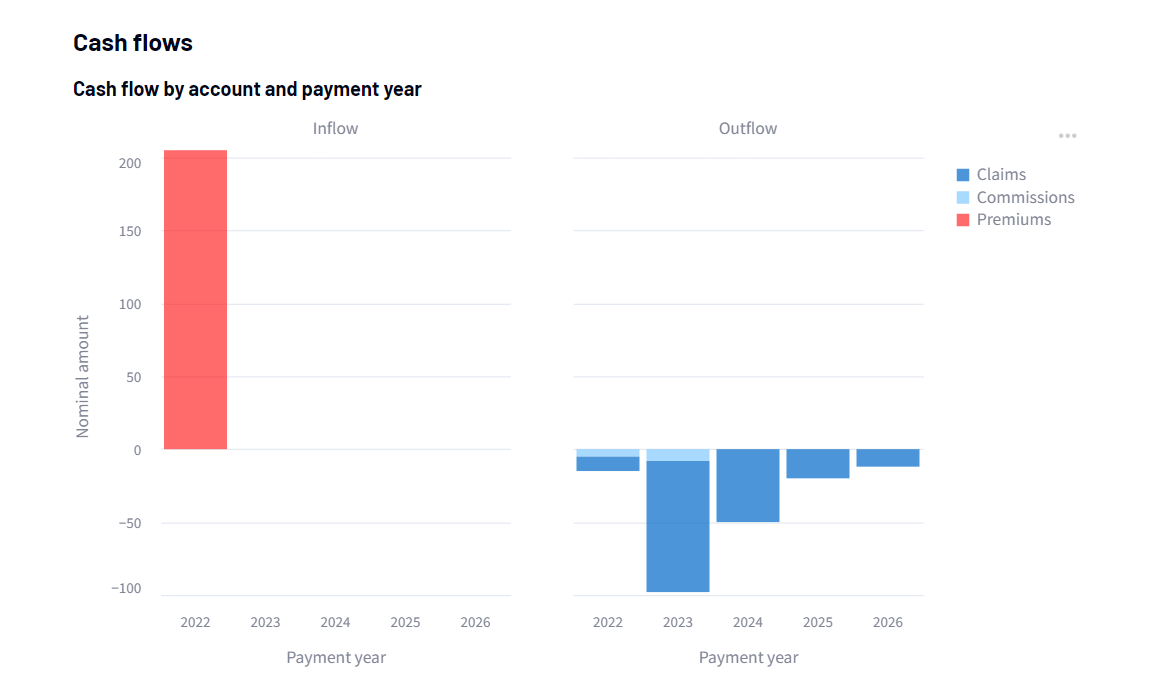

Cash flows

Assume your insurance company signed a liability contract on January 1, 2022. The contract covers potential liabilities that may arise over the next few years, allowing policyholders to submit claims from these liabilities. In exchange for this coverage, you charge a premium of $205, payable at the beginning of the first year.

Due to the usual delay in processing claims and payments, the actuary estimates that the potential claims for this insurance contract amount to $10, $90, $50, $20, and $12 for the five years respectively.

Additionally, since this contract involves the participation of a broker, your company pays a commission of $5 in the first year and $8 in the second year.

The tables below illustrate these cash flows from two dimensions:

Cash flow by payment date

| Payment date | Premiums ($) | Claims ($) | Commissions ($) |

|---|---|---|---|

| 2022-01-01 | 205 | 0 | 0 |

| 2022-12-31 | 0 | 10 | 5 |

| 2023-12-31 | 0 | 90 | 8 |

| 2024-12-31 | 0 | 50 | 0 |

| 2025-12-31 | 0 | 20 | 0 |

| 2026-12-31 | 0 | 12 | 0 |

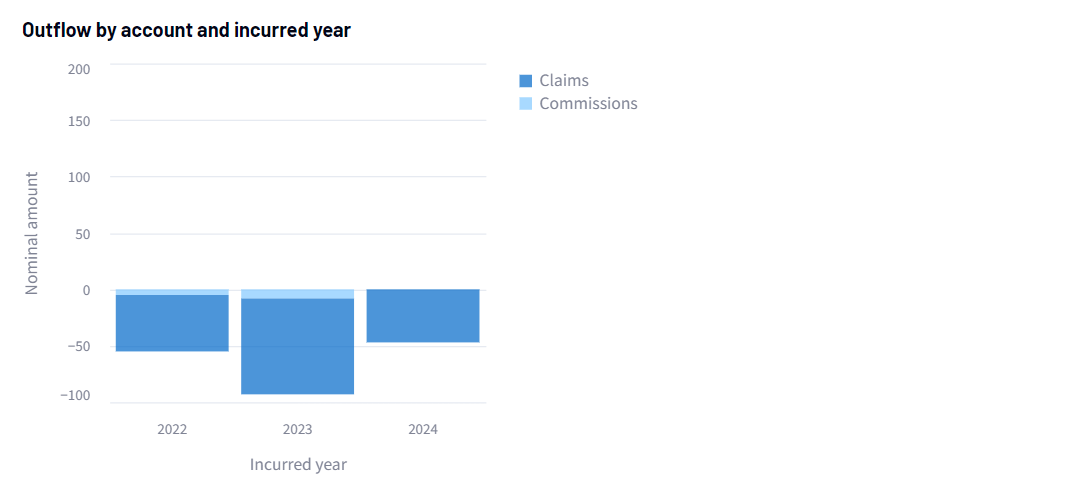

Cash flow by incurred date

Another important aspect of IFRS 17 is how cash flows are expected to be incurred. In this case, assume that $205 in premiums are incurred during the year 2022, while claims and commissions are incurred over the next three years. This dimension is important because any variance in incurred claims must be shown transparently as a separate line item in the income statement, as required by IFRS 17. However, if there are changes in assumptions regarding future expected claims, these changes are absorbed by the contractual service margin and only partially reflected in the income statement (more details will be provided in the next section).

| Incurred date | Premiums ($) | Claims ($) | Commissions ($) |

|---|---|---|---|

| 2022-01-01 | 205 | 0 | 0 |

| 2022-12-31 | 0 | 50 | 5 |

| 2023-12-31 | 0 | 85 | 8 |

| 2024-12-31 | 0 | 47 | 0 |

Year-end cash flows

Currently, we assume that the cash flows estimated at inception reflect the current economic environment. Therefore, at the end of the year, the amount remains unchanged without any experience variance adjustments.

Parameters

Discount rate

Since IFRS 17 follows a discounted cash flow model, we make assumptions regarding the interest rates at the start of the year (2022-01-01 for the inception valuation) and at the end of the year (2022-12-31 for the year-end valuation).

| Maturity (years) | 2022-01-01 | 2022-12-31 |

|---|---|---|

| 1 | 2.11% | 2.61% |

| 2 | 1.85% | 2.35% |

| 3 | 1.77% | 2.27% |

| 4 | 1.76% | 2.26% |

| 5 | 1.78% | 2.28% |

| 6 | 1.81% | 2.31% |

Risk adjustment

Under IFRS 17, the risk adjustment reflects the uncertainty around the insurance cash flows that are expected to be paid or received. It essentially serves as a buffer against adverse outcomes. The standard doesn’t specify the methodology so in our example we assume a very simple approach where the risk adjustment is 2.5% of the claims.

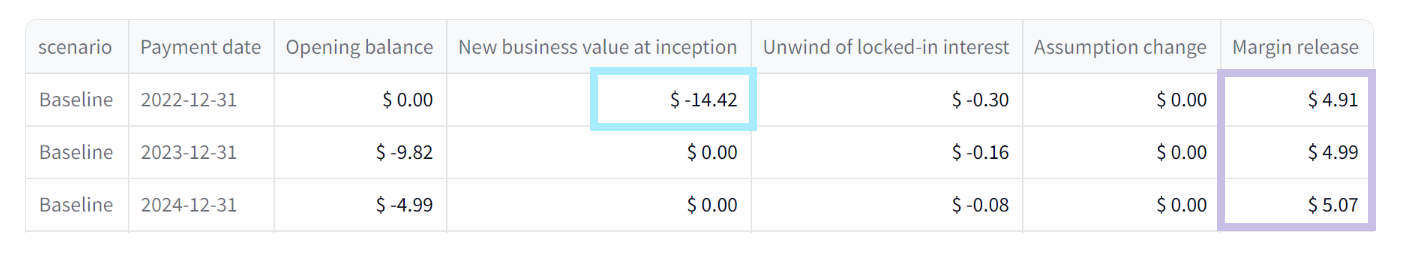

CSM run-off

The contractual service margin (CSM) represents the initial profit that over time gets released as margin through the income statement. It depends is released over the coverage period in a manner that reflects the remaining services to be provided.

In our example that the CSM is released linearly over three years.

IFRS income statement

Based on the information above, let’s have a look at the IFRS income statement. To get to the income statement, we need to discount the future payments and process them through the IFRS model. In a future blog post we will explain how each of the income statement items is calculated.

In 2022, expected claims and commissions are reflected as expected revenue and expected expenses. There is no variance in revenue or expenses, as we assumed no change to the cash flows at year-end. The bottom line profit for the year is solely contributed by the margin release, which consists of contractual service margin release and risk adjustment release.

What are the effects of inflation?

General inflation rate may lead to a claims inflation depending on the specific service provision field that the insurance company relies on to fulfill its obligations. In this scenario, let's assume that your company experiences a 2.5% increase in claims payments for the claims that have already been incurred, and also adjusts future estimations to be 2.5% higher.

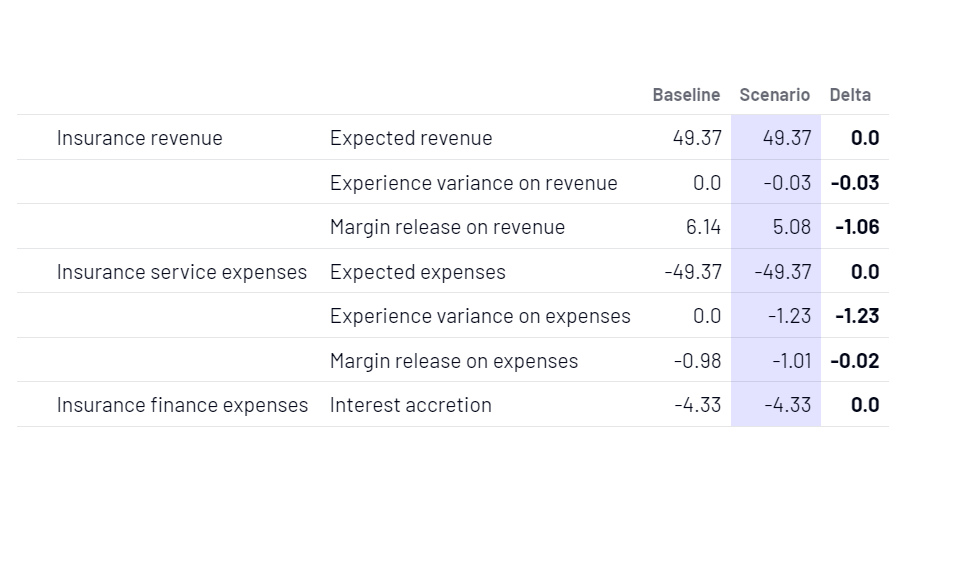

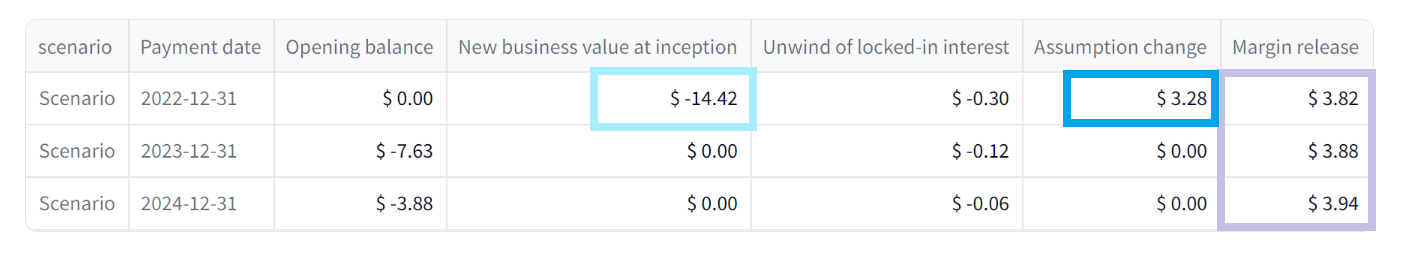

The impact of this can be observed in two parts of the IFRS 17 income statement. In the income statement below, the Scenario column represents the result after inflation, while the Baseline column represents the initial case where we assume no changes occur by the end of the year.

Changes to income statement

-

Part 1 - Experience variance on expenses: This represents the increase in expenses due to claims that have already been incurred by the end of the year. Referring to the table, it shows that $50 worth of claims were incurred in 2022. A 2.5% increase on $50 amounts to $1.25. After discounting, this becomes approximately $1.23, which directly contributes to the experience variance in expenses. Since the risk adjustment is partially dependent on claims in this example, an increase in claims leads to a $0.03 increase in the risk adjustment, which is reflected as experience variance in revenue.

Incurred date Claims ($) Inflation ($) Inflated Claims ($) 2022-12-31 50.00 1.25 51.25 2023-12-31 85.00 2.13 87.13 2024-12-31 47.00 1.18 48.18 -

Part 2 - Margin release on expenses and revenue: This refers to the reduction of the release of contractual service margin and risk adjustment. The initial profit is $14.42 with slight increase of CSM every year due to interest accretion and finally a margin release. After three years the entire CSM is run off with margin releases of around $5 each year.

A 2.5% increase results in an increase in future claims of $3.31 (claims of incurred dates that are in the future, i.e. $2.13 plus $1.18). However, this $3.31 does not directly appear as a loss in the income statement. Instead, it is reduces the contractual service margin that acts as a buffer. After discounting, the assumption change becomes $3.28 (blue), which reduces the initial contractual service margin of $14.42. As a result, the margin release for each future year is reduced from around $5 to below $4 (compare the violet boxes). This is why the margin release only decreases by $0.9 in 2022, but it will also decrease in the following two years' margin releases.

What does this mean?

We are aware that inflation has a negative impact on non-life insurers, regardless of the accounting standard they follow. This effect is particularly evident under IFRS 17, as it directly appears as negative experience variance in the income statement. However, as pricing adjusts during an inflationary period, new business will be underwritten with higher premiums and accurately estimated claims. This could result in an increase in revenue at the same time.

Non-financial risk vs financial risk

The article has so far discussed inflation as a non-financial risk. However, it's important to note that inflation can also be regarded as a financial risk. In such cases, the assumption is locked-in and does not directly impact the Contractual Service Margin (CSM). Instead, the changes will appear as other comprehensive income. One interpretation of whether inflation is viewed as a financial risk depends on if the contract is directly linked to the Consumer Price Index (CPI). For instance, if a claim covers employee salaries and these salaries are directly tied to the CPI, then an increase in salaries in an inflationary environment can be considered a financial risk. If not, it cannot be regarded as such. However, the standard does not clearly define financial risk, leaving it to the insurance carrier to establish a clear definition in its accounting policy.

🔎 To delve deeper into this topic, you can explore our interactive tool powered by a powerful fully-equipped IFRS 17 engine at training.adaptive.inc.

When inflation is high, interest rate also increases, what happens to insurance companies under IFRS 17 when interest rate environment changes? Will this impact the profit of the insurance company?

Stay tuned for more insights: www.adaptive.inc